Blog

Management buyouts are a great tool for buyers and sellers alike, as the structure aligns both parties with a common

Most forms of private capital are described legally in a way that pinpoints their collateral position or ranking. Terms such

With middle market acquisition financing, cost measurement is anything but a simple calculation. Most rookie buyers approach loan pricing as

Growth capital in the form of structured debt or equity, involves a few timing variables that are important to understand.

Acquisition financing has a coveted place in the middle market. It is an intensely sought form of capital, and is

An important consideration of selecting a lender is their track record in tough situations. All Companies face turbulence during the

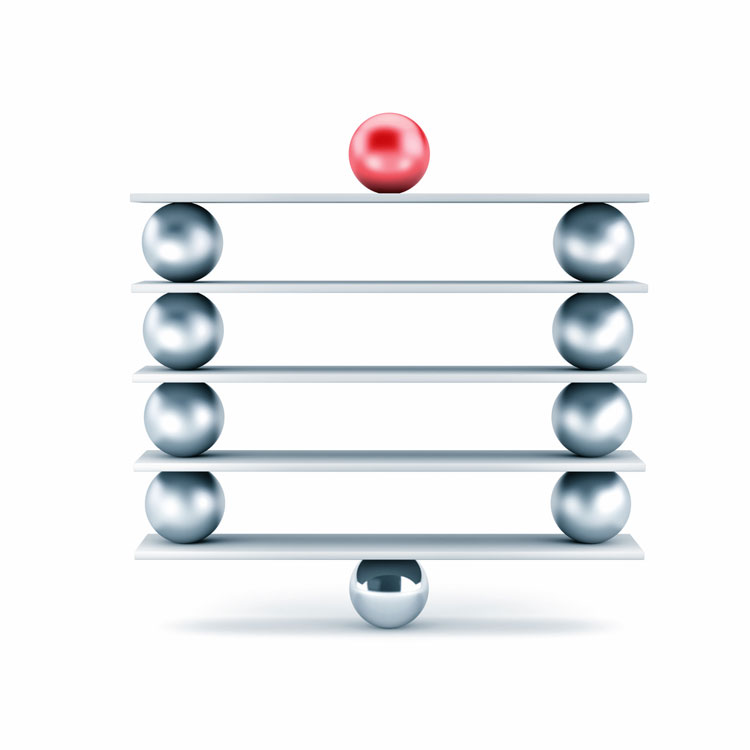

Raising capital is a lot like diving off a steep cliff, like Instagram cliff diving reels where a person lunges

Middle market companies sometimes overlook the importance of selecting an acquisition financing lender. Most see this as a cost optimization

Management buy-outs are one of the highest quality deal types in the eyes of the mezzanine debt lender market for